Smart Money Enters As Dumb Money Exits

If you follow the action in gold and silver closely, you’re about to learn something pretty soon.

Banks are mostly option writers and so when retail traders see golden skies ahead and buy long call options for gold, the banks take the opposite side of the trade. If you would be a bank which would have hundreds of millions of dollars worth of money tied to written call options, where would you want the price to be at the time of expiration? The clear answer is low. Today is the option expiration date for gold futures. The banks are notorious on manipulating the precious metals markets by slamming the market with huge volume as I pointed out in the June 16 Weekly Report. What do you think is happening right now?

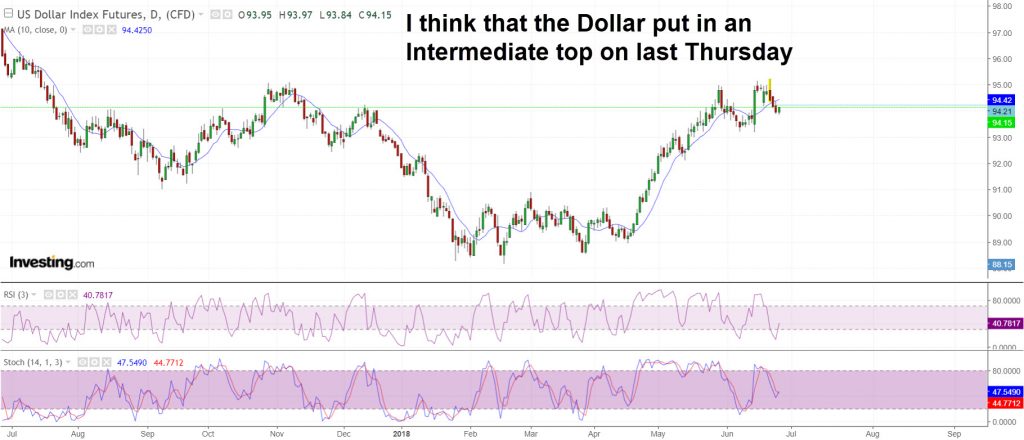

The dollar has a tight inverse correlation with gold and the dollar seems to have put in an intermediate degree top. If the dollar finally manages to roll down to lower lows, that should really boost gold higher towards the 2016 top and possibly above.

Banks use these dumps to cover shorts and to enter longs. As price falls below big pivot points, lots of retail traders’ stops are triggered. This creates loads of liquidity which is needed for big players to enter into positions.

The question is: Will you use this for your Exit or your Entry? I would ride with the banks.

To receive instant notifications on new posts, follow SKAL Capital on Twitter.