Sentiment is the measure of bulls and bear on the market. Sentiment can be measured on different timeframes from few days to multiple years. When prices increase, people tend to become more bullish and when markets decline, people tend to turn bearish. This is because of their recency bias which means that people tend to extrapolate past performance into the future. If price has been moving up for a year, people tend to think that prices will go up the next year as well. Same applies when markets have been moving down.

Why do I follow sentiment so closely? This question is easy to answer. Because markets are about people interacting with each other and I’m a contrarian. Being a contrarian means anticipating market turns as well as trend changes and taking positions based on that. This means buying low and selling high. As I explained in the What is Smart Money article, most traders and investors follow their emotions and make decisions based on that. They wait and wait until prices have risen long enough for them to feel safe about the trade before buying. This of course is often a very poor strategy as prices tend to turn down once retail traders feel safe to buy. This is the point when a contrarian wants to sell, in anticipation of a move lower due to exhaustion in buying pressure.

Markets are about humans interacting with each other. Humans often make decisions based on their feelings which accelerates price swings in the market. Even if people say that algorithms drive the prices nowadays, these algorithms are also designed by humans who are always bias in a way or another. People think and move in herds just like sheep. One sheep gets scared and infects others with fear. This is what happens when prices start moving down – few traders get scared and sell their positions, which results in selling pressure and price starts moving down. As the price falls, more and more bearish indications are triggered resulting in more selling. At the end of this chain reaction there is panic in the markets and you can see this clearly from the news and mainstream media. Once every bull has turned bearish, the market runs out of sellers and price reverses to the upside. The pattern repeats over and over and over again on all time frames. When people are panicking, you want to be buying, not selling.

In order to make educated decisions you need to start thinking independently from the rest of the crowd and you need proper tools. There are lots of different sentiment indicators online of which some are better than others. I don’t encourage using some free tools as they are more often than not completely useless. I use for my analyses data from SentimenTrader as their tools and indicators have been reliable and functional.

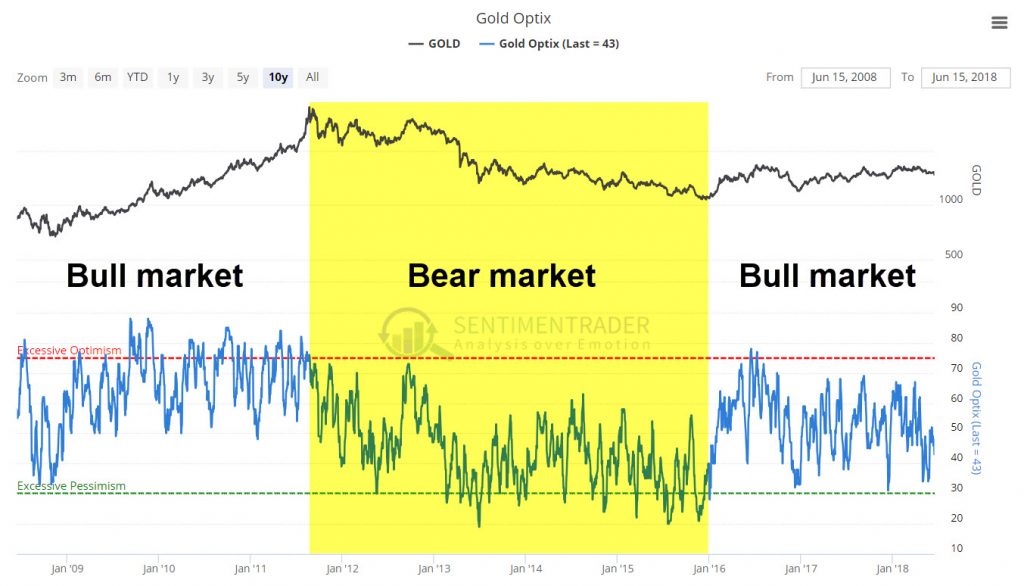

Source: sentimentrader.com

Above you can see a 10 year chart of gold and SentimenTrader’s Optix indicator which measures the optimism and pessimism on the market. As we can see from the indicator, when we are in a bull market, optimism is most of the time bullish and rarely passes to extreme pessimism. The exact opposite is true for a bear market like we had in gold from 2011 to 2015. In cycles trading, the key is to catch bottoms and ride trends. One of the common denominators of bottoms is fear. Price moves down, people get bearish and sell. In order to know how bearish the markets truly are you need to see what the prevalent sentiment is.

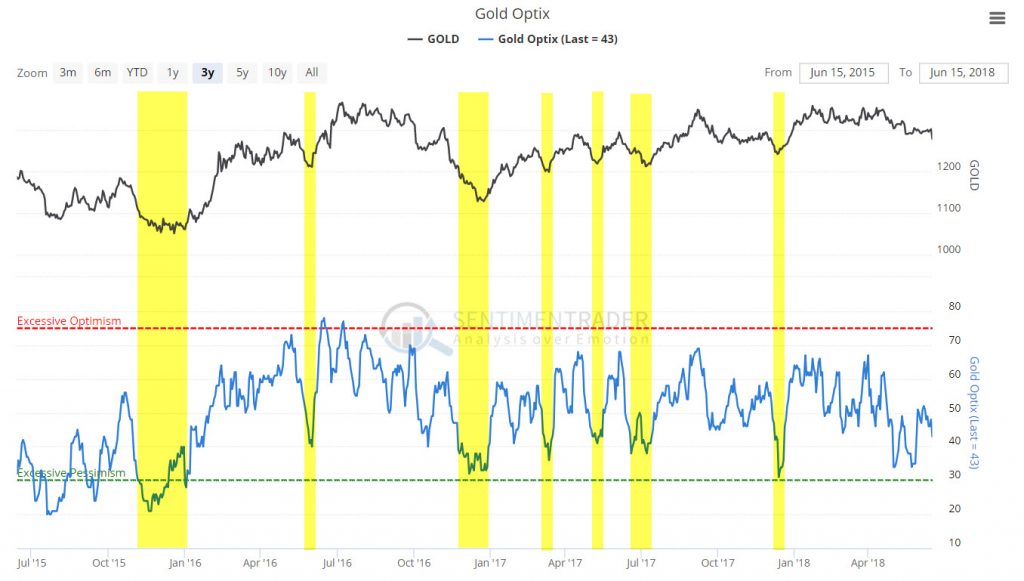

Source: sentimentrader.com

Anyone can see from the chart above that buying when people are fearful, and sentiment is below the mean is a really good strategy. The question is, can you control your emotions in real time in order to make the right move at the right time when the all the other lemmings are heading towards the cliff.

To receive instant notifications on new posts, follow SKAL Capital on Twitter.